Korea’s “bio fever” is being spurred on by the domestic development of biosimilars by firms such as Celltrion, Samsung Bioepis, LG Chem, GC Green Cross, Chong Kun Dang, CJ Healthcare, and Dong-A ST.

As the global biosimilar market is expected to grow explosively with more than 20 biologic products falling off the patent cliff by 2022, several domestic biopharma firms have jumped into biosimilar development.

Biosimilars, which are almost identical copies of the original drug, are often cheaper since they are developed by referencing the biologic drug that has gone off patent and thereby require less R&D expenditures.

The global biosimilar market, which stands at nearly $6 billion, is expected to reach $24.6 billion by 2023, growing at a compound annual growth rate of 31.7 percent.

Against this backdrop, Korea Biomedical Review compiled the pipelines of the seven Korean biopharmaceutical firms developing biosimilars.

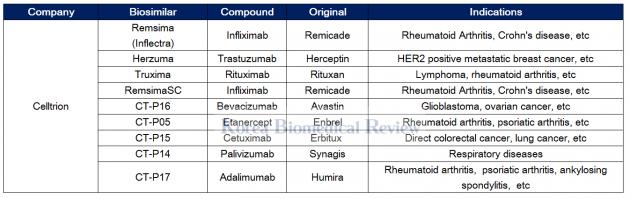

Celltrion leads the way with Remsima

Celltrion has been at the forefront of biosimilar development since its foundation in 2002, becoming the world’s first to get approval for a biosimilar therapy with Remsima (infliximab) – a copy of Janssen Biotech’s Remicade.

Remsima is used to treat many diseases such as rheumatoid arthritis, Chron’s disease, ulcerative colitis, ankylosing spondylitis, psoriatic arthritis, and psoriasis.

The therapy has been the cash cow for Celltrion, with a recent earnings report showing its sales to account for a whopping 52 percent of first-quarter sales for the company. According to the Korean biopharma firm, Remsima uptake has been strong in Europe and steadily climbing in the U.S.

Celltrion has also seen success with its Rituxan biosimilar called Truxima, launching it as its third biosimilar in the European Union.

The company has nine biosimilard in its pipeline for Avastin, Enbrel, Erbitux, Synagis, and Humira biosimilars, including the phase 3 trials for its subcutaneous injectable form of Remsima dubbed the RemsimaSC.

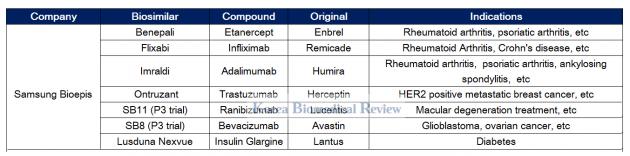

Samsung Bioepis expands presence in Europe with biosimilars

Samsung Bioepis, the conglomerate’s biosimilar arm founded in 2012, has six drugs officially listed on its pipeline.

The firm has grown to become the only company to get four biosimilars of Enbrel, Remicade, Humira, and Herceptin – Benepali, Flixabi, Imraldi, and Ontruzant – approved in Europe.

Bioepis has also been engaged in a fierce competition with Celltrion in Europe to gain market share for its Herceptin biosimilar. Bioepis launched its Herceptin biosimilar called Ontruzant in the EU in March - two months earlier than Celltrion’s Herzuma. Despite getting an early start, local reports showed neither has so far staked out a dominant share in the market.

Samsung also funded Merck's development of a Lantus biosimilar called Lusduna Nexvue and has phase 3 trials for Avastin and Lucentis biosimilars underway.

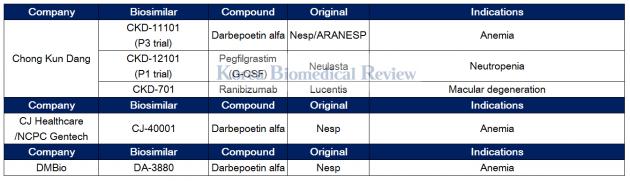

Chong Kun Dang, Dong-A ST, and CJ Healthcare develop NESP biosimilars

Chong Kun Dang has been busy developing biosimilar CKD-11101 for Novel Erythropoiesis Stimulating Protein (NESP) therapy for anemia. The NESP therapy, a copy of Amgen’s Aranesp, has been off patent since 2015.

The pharmaceutical firm applied for the Ministry of Food and Drug Safety’s approval for CKD-11101 in December. If approved, CKD-11101 will be launched as the world’s first NESP biosimilar next year.

Recently, the company got a patent for the therapy that relates to a differentiated method of refining pure darbepoetin alpha, a central ingredient for NESP, which has a complicated structure.

"We plan to accelerate our entry into the global NESP market, which is worth 2.8 trillion won ($2.6 billion),” a company official said.

Chong Kun Dang is also in preclinical trials for Lucentis and Neulasta biosimilars.

Along with Chong Kun Dang, Dong-A ST and CJ Healthcare are working to develop a NESP biosimilar.

Dong-A ST created a joint venture with Japan’s Meiji Holdings called DMBio to develop NESP biosimilar DA-3880. The drug is in phase 3 trials.

Meanwhile, CJ Healthcare is working with YL Biologics to develop CJ-40001, a NESP biosimilar, in Japan.

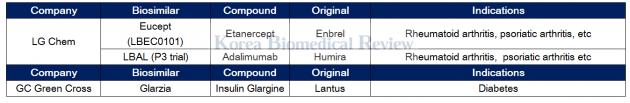

LG Chem gets MFDS nod for Enbrel biosimilar, GC Green cross for Lantus biosimilar

LG Chem recently got the nod from the Ministry of Food and Drug Safety to sell Eucept, an Enbrel biosimilar, to treat a range of autoimmune diseases. The approval of Eucept marks the second Enbrel biosimilar to get regulatory approval in Korea.

LG Chem is now running a phase 3 trial for a Humira biosimilar called LBAL.

GC Green Cross got approval for its biosimilar Glarzia (original: Lantus) in March from the Ministry of Food and Drug Safety to treat diabetes. The firm said that it would launch the therapy in the third quarter of this year.

Meanwhile, Alteogen said this month that it finished the pre-clinical trials for ALT-L9, a biosimilar of Regeneron's Eylea with plans to launch phase 1 trials in 2019.