Medicine expense to grow 4-7 percent a year until 2021

Korea’s pharmaceutical companies should differentiate their strategies in entering into advanced countries and emerging markets, a report said.

In other words, the domestic drugmakers should focus on innovative, original products in developed markets while pushing generic products with sufficient price competitiveness in “pharmerging” markets, according to “Outlook for global medicines through 2021” released by Quintiles IMS Institute.

The pharmerging market is a new term combining “pharma” from pharmaceuticals with “emerging,” referring to 17 newly rising markets, including BRICS (Brazil, Russia, India, China and South Africa) as well as Thailand and Egypt.

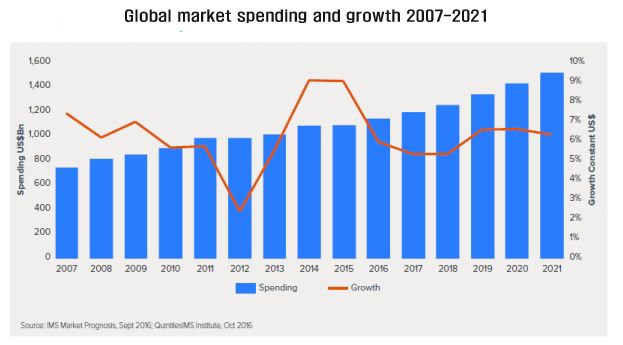

According to the report, the global medicine consumption is likely to increase 3 percent a year until 2021. The growth of drug use will, in turn, push up medicine cost by 4-7 percent on average to total about 1,700 trillion won ($1.52 trillion). Notably, the medication cost will show notable growth in the area of cancer, autoimmunity and diabetic treatment.

Although drug use and medicine spending have been on the rise, the growth rate of medication cost is slowing down because of a global trend to curb drug expense, it said.

Particularly noticeable is the slowing growth rate of drug expenditure in the United States, the largest pharmaceutical market in the world, the report said, attributing it to the stunted growth of hepatitis C treatment and an increasing number of original drugs which have lost their exclusive sales rights because of patent expirations. The slowdown in the rate of increase in drug spending in the U.S. market could bring about overall slump on the global medical supply markets, it added.

In Europe, too, the increase rate of medicine cost was projected to remain at 1-4 percent. Alarmed by the sharp increase in spending on new drugs in 2014 and 2015, policymakers in the Old Continent have begun to control drug costs.

The situation is little different in the pharmerging markets, which took the lead in increasing global use of medical supplies for five years from 2011, as the growth rate of medicine cost is slowing down because of a slowdown in GDP growth rate and weakening currencies, the report said.

Noting that the increase rate of drug cost in major pharmerging markets has slowed down to 1-4 percent, the report forecast the growth tempo will remain sluggish there, too.

“The consumption of medical supplies in pharmerging markets has grown 7 percent a year on average over the past five years, but the annual average growth rate from 2016-2021 is expected to fall to 4 percent,” the report said,

Accordingly, the domestic drugmakers should focus on innovative, original products in developed countries where medicine expense remains high while exporting price-competitive generic drugs to pharmerging markets where generics account for 91 percent of the total drug use, the report advised.

Based on the report, Keven Huh, general manager of QuintilesIMS Korea, gave advice to the domestic drugmakers in entering overseas markets.

“We should take heed of the fact that the estimated medicine cost of 273 trillion won ($241 billion) in advanced markets by 2021 is as much as 2.8 times higher than the 98.6 trillion won in pharmerging markets, absolutely surpassing the latter,” he said.

Huh noted that the medical cost person is 2.2 million won in the U.S., 650,000 won in Japan, and 58,000 won in EU, while the comparable spending in the pharmerging markets remains at about 130,000 won on average. “The per capita medicine cost in pharmerging countries is four to 16 times smaller than that in advanced countries,” said Huh.

“In developed markets, innovative, original products which account for 69 percent of the total cost will likely play the role of locomotive for Korean pharmaceuticals’ market advances until 2021. ON the other hand, in pharmerging markets where original products struggle because of weak protection of intellectual property rights and financial burdens, price-competitive generics will play the same role,” he said.

Huh also stressed Korean drugmakers should take into account that anticancer drugs, autoimmunity, and antidiabetics treatment will grow to about 350 trillion won over the next five years to account for more than 30 percent of global medical supply market.

“It is imperative they make brisk research and development efforts in related areas,” he added.