Law firm recruits investors for 2nd suit against drugmaker

OhKims Law and Company is recruiting investors for its second suit against Medytox, which allegedly inflicted heavy losses on its shareholders by making a public announcement of false information.

On April 22, the law firm filed the first indemnity suit against the drugmaker on behalf of about 100 Medytox shareholders, claiming the company violated the Capital Market Act by manipulating information on Medytoxin’s stock solution and the results of its potency test and making false public notice as well as the possibility of fraudulent trading of own stocks.

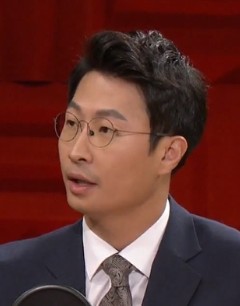

“We will go ahead with this legal battle by filing the third suit if needed,” said Um Tae-seop, a lawyer in the law firm responsible for the case. “The scale of losses is larger than other similar suits, ranging from 20 million won ($16,400) or 30 million won to as much as 1 billion won.”

In an interview with Korea Biomedical Review on Tuesday, Um reiterated that these suits are aimed to help restore the damages of shareholders.

It all began on April 17, when the Ministry of Food and Drug Safety ordered the suspension of manufacturing, selling, and using Medytox's botulinum toxin medication, Meditoxin, and took the process for canceling the item license. The products targeted for the revocation of permits were 50, 100, and 150 units of Meditoxin injections.

The ministry explained that Medytox falsely stated the ingredient information of Meditoxin and manufactured it differently from the licensed content.

"The prosecution's announcement of Medytox's violation of the Pharmaceutical Affairs Act concerns only the remaining five years out of the statute of limitations,” Um pointed out. “However, the company misled investors by distorting the facts as if only the products made with unlicensed material between December 2012 and June 2015 had been the problems.”

Um said Medytox threw investors into further confusion by claiming that products made after the period had no problems without providing any explanation for its false disclosures. It alleged that the products made from December 2012 to June 2015 pose no health risks as they were all used up a long time ago.

Um said he had requested Medytox to explain the official notice stating that the stocks were issued to pay employee bonuses, severance pays, and merit pays. Still, the company remained silent on that, too.

“Unlike the disclosure, the company might have given the treasury shares to those who are not executives or employees,” he said. "We requested answers for the doubtful situation, but the company responded that it could not provide a clear answer as they are in the litigation process."

The law firm is preparing for the second lawsuit to be filed as early as late this month or around mid-June. It will continue filing suits with additional victimized investors.

A public hearing on the cancellation of licenses for Meditoxin is scheduled for May 22. It is an administrative procedure that listens to the company's positions before finalizing the decision under Article 77 of the Pharmaceutical Affairs Law. It is the final opportunity for the company to defend its positions.

If the ministry decides to terminate the license, Meditoxin, which takes up about 42 percent of the company's total revenue, will be kicked out of the market. So far, no preliminary decisions to revoke licenses have been reversed after such hearings.